Trading the News: Canada Consumer Price Index

What?s Expected:

Time of release: 07/19/2012 12:30 GMT, 8:30 EDT

Primary Pair Impact: USDCAD

Expected: 1.2%

Previous: 0.7%

DailyFX Forecast: 1.0% to 1.2%

Why Is This Event Important:

The headline reading for Canadian inflation is expected to increase an annualized 1.2% in May, and the pickup in price growth may heighten the appeal of the loonie should the data renew bets for higher borrowing costs. Although we?re seeing the Bank of Canada (BoC) retain a cautious outlook for the region, a faster rate of inflation may encourage Governor Stephen Poloz to adopt a more hawkish tone over the coming months, and the central bank may normalize policy further over the medium-term as the economy.

Recent Economic Developments

The Upside

| Release | Expected | Actual |

| Net Change in Employment (JUN) | -7.5K | -0.4K |

| International Merchandise Trade (MAY) | -0.70B | -0.30B |

| Quarterly Gross Domestic Product (Annualized) (1Q) | 2.3% | 2.5% |

The Downside

| Release | Expected | Actual |

| Business Outlook Future Sales (2Q) | 30.00 | 9.00 |

| Raw Materials Price Index (MoM) (MAY) | 0.4% | 0.2% |

| Retail Sales (APR) | 0.2% | 0.1% |

Firms in Canada may look to raise consumer prices amid the underlying strength in job growth along with the expansion in private sector credit, and a positive development may heighten the appeal of the Canadian dollar should the data spark bets for a rate hike. However, the slowdown in private sector consumption paired with easing input costs may drag on price growth, and a weak inflation print may keep the BoC on the sidelines for an extended period of time as the central bank aims to encourage a stronger recovery.

Potential Price Targets For The Release

As the USDCAD breaks out of the consolidation phase dating back to 2011, we should see the upward trending channel continue to take shape over the near to medium-term, but we may see a move back towards trendline support should Canada?s CPI report renew bets for a BoC rate hike. However, we will look to buy dips in the USDCAD as the bullish trend takes shape, and we may see another run at the 1.0600 handle amid the deviation in the policy outlook.

How To Trade This Event Risk

Forecasts for a faster rate of inflation highlights a bullish outlook for the loonie, and the market reaction may set the stage for a long Canadian dollar trade as it fuels bets for a rate hike. Therefore, if consumer prices increase 1.2% or greater in June, we will need a red, five-minute candle following the release to establish a sell entry on two-lots of USDCAD. Once these conditions are fulfilled, we will place the initial stop at the nearby swing high or a reasonable distance from the entry, and this risk will generate our first target. The second objective will be based on discretion, and we will move the stop on the second lot to cost once the first trade hits its mark in order to lock-in our profits.

However, the slowing recovery may continue to drag on price growth, and a dismal print may prompt a bearish reaction in the Canadian dollar as market participants scale back bets for higher borrowing costs. As a result, if the CPI disappoints, we will implement the same setup for a long dollar-loonie trade as the short position mentioned above, just in reverse.

Impact that the Canada Consumer Price report has had on CAD during the last month

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

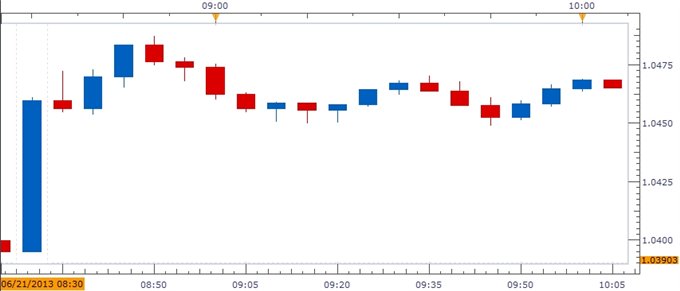

| MAY 2013 | 06/21/2013 12:30 GMT | 0.9% | 0.7% | +72 | +60 |

May 2013 Canada Consumer Price Index

Consumer prices in Canada increased an annualized 0.7% during the month of May after expanding 0.4% the month prior, while the core rate of inflation held steady an 1.1% amid forecasts for a 1.2% print. Indeed, the weaker-than-expected release dragged on the Canadian dollar, with the USDCAD climbing above the 1.0475 region, but we saw the loonie consolidate during the North American trade as the pair ended the day at 1.0455.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com.

Follow me on Twitter at @DavidJSong

To be added to David's e-mail distribution list, please follow this link.

Click Here to Sign Up for DailyFX Plus

New to FX? Fill Out This Quick Form for a Free Tutorial

Questions? Comments? Join us in the DailyFX Forum

original source

David Song focuses on economic developments and central bank rhetoric to forecast long term currency price action. As an active trader, he relies on technical analysis for shorter-term forecasts. David has been quoted by many major news sites including Reuters, Dow Jones Marketwatch, and CNN Money.

Expertise: Central bank policy, economic indicators, and market events.

Hours: 7:00 am ? 4:00 pm ET

Email: dsong@fxcm.com

Location: New York

Twitter: @DavidSong

DailyFX?provides forex news and technical analysis on the trends that influence the global currency markets.?Learn forex trading with a free practice account and trading charts from?FXCM.

Source: http://www.insidefutures.com/articles/article.php?id=1005058

blake griffin pau gasol marlins park marbury v. madison 2013 lincoln mkz burger king mary j blige google project glass

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.